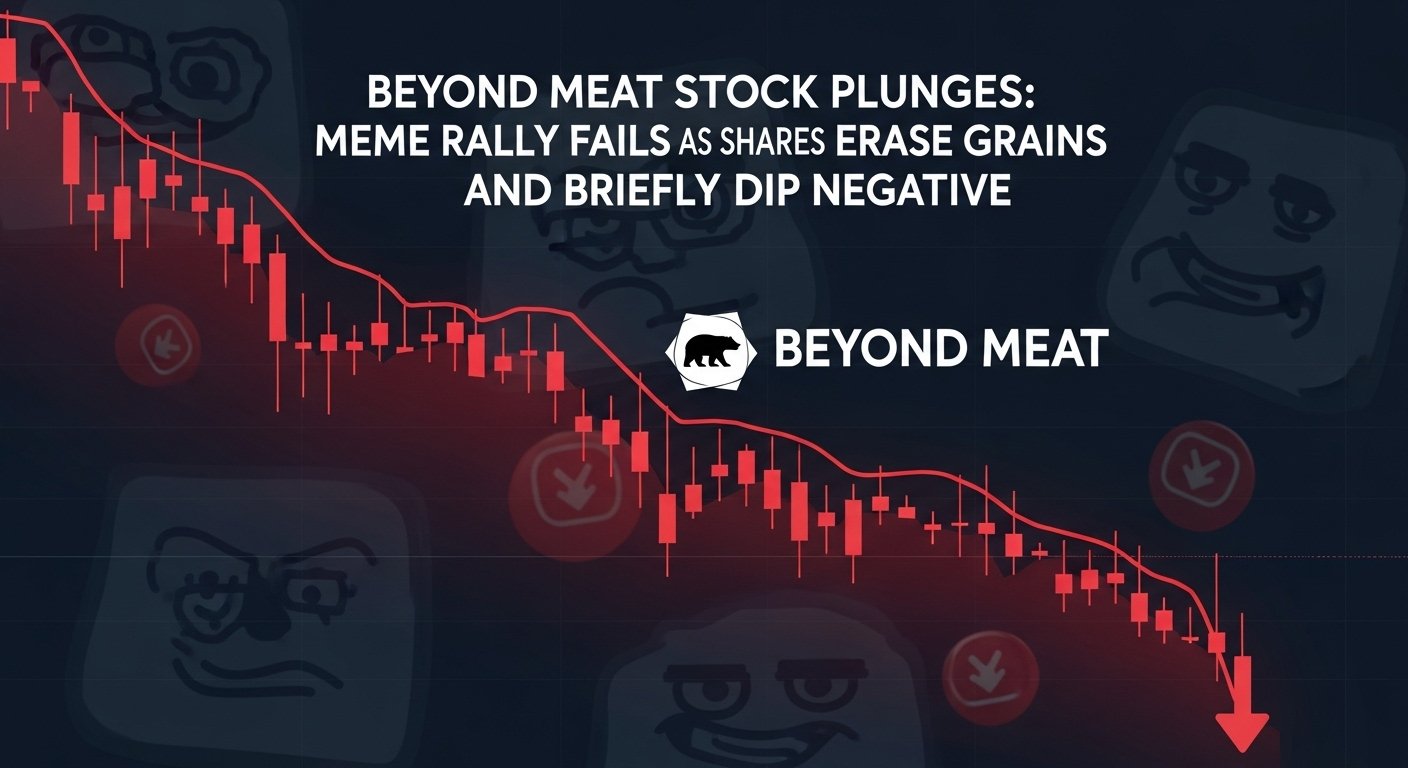

Beyond Meat Stock Volatility: Meme Rally Fizzles After Explosive Surge

Beyond Meat (BYND) shares experienced extreme volatility on Wednesday, rapidly slashing initial gains and briefly dipping into negative territory. This dramatic reversal occurred as the much-hyped meme stock rally faltered, erasing a staggering 112% intraday surge. The stock had climbed to a session high of $7.69, a sharp increase from its Tuesday closing price of $3.62, before settling back above $4.

The initial explosive movement was significantly influenced by Roundhill Investments’ decision on Monday to add BYND to its Roundhill Meme Stock ETF. This inclusion appeared to trigger a substantial short squeeze in the stock, prompting numerous investors who had bet against Beyond Meat shares to quickly cover their positions. However, the momentum proved unsustainable, highlighting the inherent risks of meme stock investing and the rapid shifts in market sentiment for plant-based meat stocks.

Beyond Meat Stock: Meme Rally Fizzles After Wild 112% Surge and Walmart News

Beyond Meat (BYND) shares experienced a dramatic reduction in gains on Wednesday, briefly dipping into negative territory as the recent meme stock rally lost momentum. The plant-based food company, famous for its vegan burgers and sausages, saw its stock rise by just 15% in midday trading, a significant drop from an earlier 112% intraday surge. The share price peaked at $7.69 during the session, up from Tuesday’s close of $3.62, before settling back around $4, with a 14% gain.

This week has been extraordinary for Beyond Meat stock. On Monday, BYND rallied over 127% after Roundhill Investments added the company to its Roundhill Meme Stock ETF (MEME). This strategic inclusion ignited a substantial short squeeze, forcing a rush of investors who had bet against Beyond Meat shares to cover their short positions, with FactSet data showing over 63% of available shares were shorted.

The incredible upward trajectory continued on Tuesday, as Beyond Meat soared 146%—marking its best day ever—following the announcement of expanded distribution in Walmart stores. However, Wednesday’s correction indicates that while positive news and meme stock momentum can drive massive gains, such rallies are often unsustainable, leading to high volatility in alternative protein market stocks.

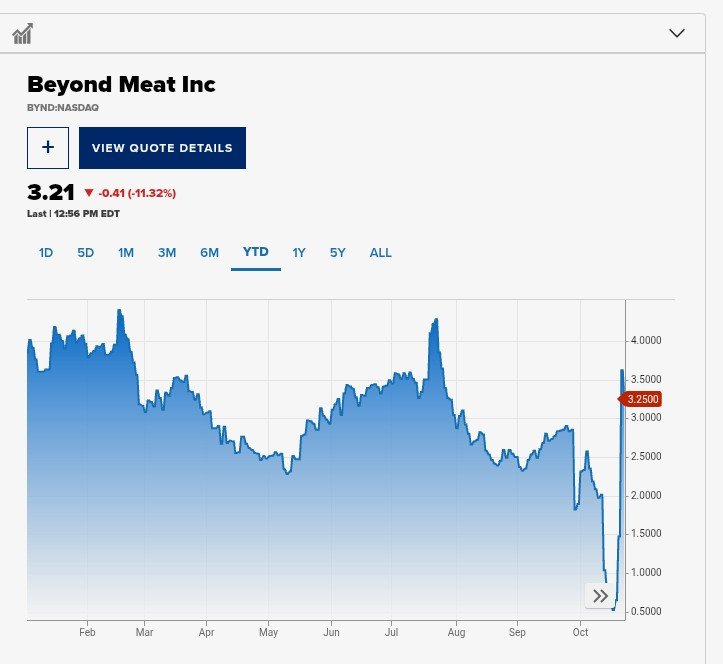

Beyond Meat’s Tumultuous History: From IPO Highs to Penny Stock lows, Fueled by Meme Rallies

Beyond Meat (BYND) shares have endured sustained pressure since their 2019 public debut, plummeting from an initial high exceeding $230 per share to becoming a penny stock. The company’s stock has consistently declined over the past five years, with significant drops of 47% in 2021, 81% in 2022, 27% in 2023, and 57% in 2024, extending into a more than 3% loss in 2025 year-to-date.

The latest wave of bad news for BYND stock hit last week when shares tumbled over 67%, closing at just 65 cents, following the finalization of a debt deal.

The Resurgence of Meme Stock Mania

However, this week’s dramatic comeback is highly reminiscent of the pandemic-era meme stock craze, where retail traders on platforms like Reddit’s WallStreetBets coordinated high-risk, aggressive trades. In 2021, Bank of America even flagged Beyond Meat as a “Reddit stock to watch,” despite it ending that year with losses.

The recent resurgence of Beyond Meat’s stock could signal a frothy market, characterized by relentless upward climbs amidst concerns over elevated valuations and a potential artificial intelligence bubble. Notably, Roundhill Investments had previously shut down its meme ETF due to lack of interest, only to revive it this month as retail traders aggressively re-entered the bull market.

Comments from WallStreetBets reflected the extreme volatility, with one user noting a rapid $7,000 loss on a recent BYND purchase. Another commenter cynically remarked, “You know the economy is cooked when BYND stock is making a comeback,” underscoring the perceived disconnect between the stock’s performance and underlying economic fundamentals.