As the US government shutdown continues, federal employees are facing severe financial uncertainty, a situation vividly illustrated by Michael Galletly, an IT management specialist for the Department of Agriculture in Utah. Mr. Galletly, now on unpaid leave, spent over two hours with his wife meticulously strategizing their finances to navigate the crisis.

The outlook for the Galletly family is precarious. Mr. Galletly, who also serves as president of American Federation of Government Employees Local 4016, stated, “I could make it two months, maybe three lean, very lean months… But I don’t know how long this thing is going to go.” His predicament underscores the immediate and personal economic impact of the shutdown on federal workers and their households. This highlights widespread concerns about financial stability for thousands of government employees affected by the ongoing congressional impasse.

Worsening Economic Fallout: US Government Shutdown’s Ripple Effect on Businesses and Consumers

The ongoing US government shutdown has already created significant disruptions, snarling travel, delaying critical government permits and loans, and shuttering federal institutions. As millions of federal workers begin to miss paychecks this week, their inevitable curtailment of spending is poised to unleash a wider economic ripple effect.

“We’re reaching this critical inflection point… for the broader economy,” stated Stash Graham, managing director of Graham Capital Management. Early indicators suggest a decline in both business confidence and consumer sentiment, hinting at impending economic weakness. Furthermore, the suspension of vital economic data releases, such as the monthly jobs report, is exacerbating market uncertainty, leading firms to postpone spending decisions and increasing the risk of policy errors.

Michael Galletly in Utah exemplifies this tightening economic squeeze. Anticipating the shutdown’s impact, he cancelled plans for a camper trailer, purchased a second-hand laptop, and deferred home maintenance. Now facing his first missed paycheck, Mr. Galletly has applied for unemployment insurance and contacted his lenders for mortgage and car loan accommodation. Drawing on his experience from previous shutdowns—this being his third—he emphasized: “I just can’t afford to do that [hope for the best].” His proactive measures underscore the profound financial stress endured by federal employees and the urgent need for a resolution.

US Government Shutdown: Escalating Economic Risks Amid Unprecedented Actions

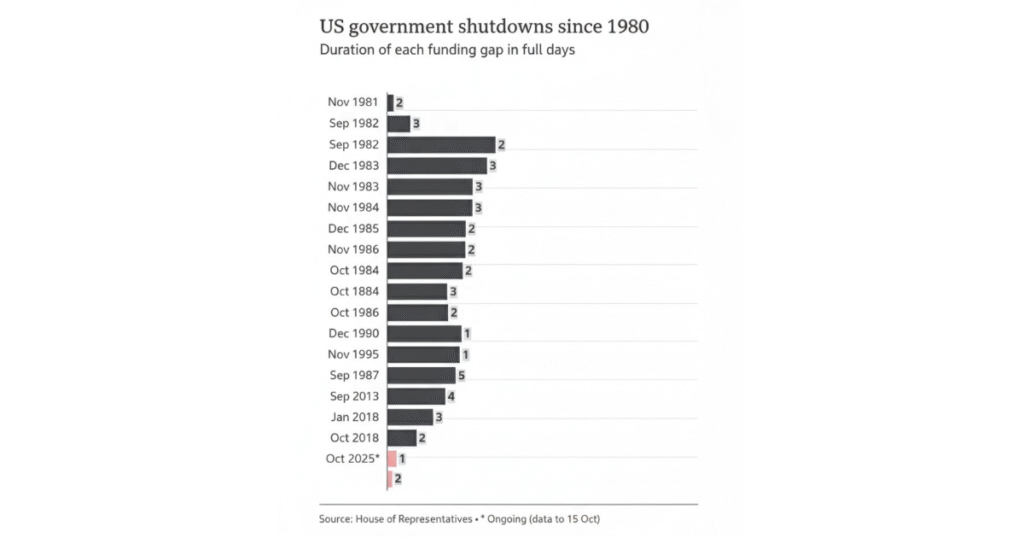

Historically, the economic impact of government shutdowns has been temporary and contained, often compared to the localized disruption of a major storm. Analysts project this year’s shutdown could shave approximately 0.2 percentage points off quarterly GDP growth per week, translating to roughly $15 billion in economic losses. Much of this is typically recovered post-shutdown when federal workers receive back pay.

However, this year’s US government clash introduces unusual economic risks. The Trump administration is threatening unprecedented actions, including denying back pay to federal employees and initiating permanent firings, a move already observed last week. This aggressive stance directly collides with an already slowing US economy, where businesses and households are grappling with anxieties over trade tariffs, immigration policy changes, and prior government spending cuts.

“We’ve already rolled the dice a lot this year,” noted Michael Zdinak, economics director at S&P Global Market Intelligence. He warned that while a short shutdown’s impact might be minimal, a protracted government shutdown could “derail the trend of steady growth.”

In recent days, the Trump administration has attempted to blunt economic pain by reallocating funds to ensure military pay and vital food programs continue. Yet, these measures have paradoxically dimmed hopes for a swift resolution, removing some of the immediate pressure points that typically push negotiations forward.

Wells Fargo analysts recently cautioned that if the shutdown “drags deep into next week, we will be venturing into uncharted territory,” highlighting that most previous lengthy shutdowns were far more limited in scope. This signals a heightened and unpredictable economic outlook for the nation.

Deepening Crisis: US Shutdown Threatens Unemployment Spike, Consumer Spending & DC Economy

The US government shutdown continues to escalate, with S&P Global Market Intelligence estimating the unemployment rate could surge to 4.8% by October 18, a significant jump from 4.3%. The White House Council of Economic Advisers recently projected a month-long shutdown could result in a staggering $30 billion loss in consumer spending. This substantial impact is partly due to the millions of government contractors who are ineligible for back pay if their work is affected.

Families Face Budget Crunch and Hard Choices

The human cost is evident in families like Allison’s in Ohio, whose husband, a Defense Department employee, is now working without pay. Their family of five has already canceled a fall getaway, opting for a day trip to save money. Allison, who preferred not to be fully identified due to concerns about political attacks, stated their budget has “little wiggle room” after recent living cost increases. They immediately contacted their bank to defer their November mortgage payment and fear an extended shutdown could force their children to drop extracurricular activities. “If this continues through December, I don’t know what we’re going to do,” she expressed.

Washington D.C. Braces for Severe Economic Repercussions

While the federal government employs people nationwide, the Washington, DC region is bracing for some of the most severe economic repercussions. Already reeling from previous government job cuts, the metro area witnessed a 5 percentage point drop in consumer spending during the 2013 shutdown, far exceeding the national average.

Local businesses are feeling the immediate sting. Daniel Kramer, managing partner of popular DC restaurants Duke’s Grocery and Duke’s Counter, reported a sales drop of over 50% at Duke’s Counter following the National Zoo’s closure. “It’s not just federal workers and contractors who are affected here. It’s the entire ecosystem,” Kramer emphasized, highlighting the widespread damage to the local economy and consumer confidence.